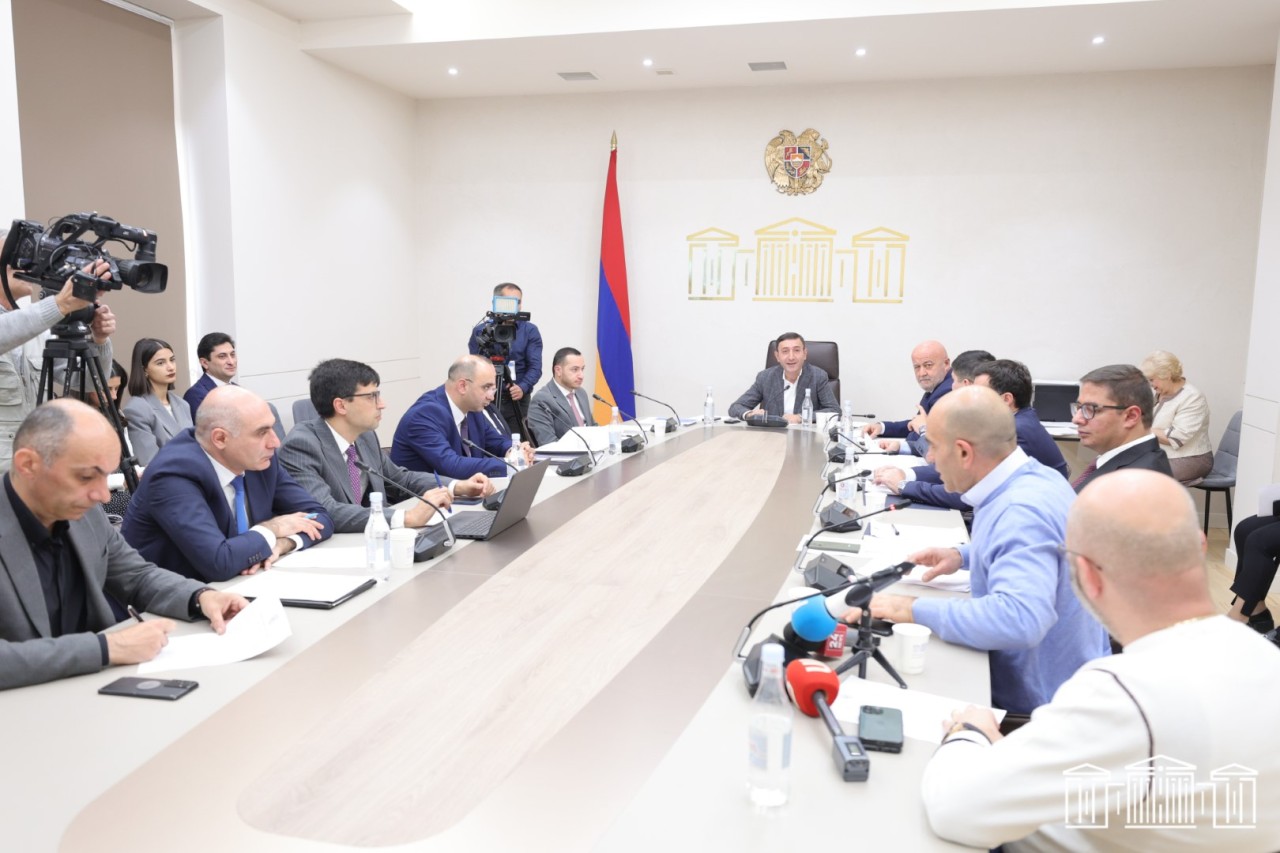

NA Committee Approves Draft Laws on Tech Sector Development

At an extraordinary session of the Standing Committee on Economic Affairs of the National Assembly held on November 11, the draft laws “On State Support of the High Technologies Sector” and “On Amendments and Additions to the Tax Code of the Republic of Armenia” were approved.

RA Minister of High-Tech Industry Mkhitar Hayrapetyan presented the bill, emphasizing its urgency as recognized by the RA Government. He highlighted that the initiative aims to outline directions for state support and offer tax incentives within the high-tech industry.

“Specifically, the draft law "On State Support of the High-Tech Sector" proposes to provide support to organizations and individual entrepreneurs in the high-tech sector in the following areas:

1) Labor Migrant Involvement – Support is offered to businesses hiring migrant workers as professional staff, covering 50% of the income tax calculated on the worker’s salary and equivalent payments.

2) New Employee Incentives:

• Full income tax coverage on wages for new employees if the business has 30 or fewer employees (mainly startups).

• 50% income tax coverage on wages for new employees if the business employs 31 or more people.

It is noteworthy, that support for new employees will last for three calendar years from the date of first employment.

3) Education and Training Compensation – To cover educational expenses incurred for the preparation and training of personnel performing professional work for the business entity:

• A 50 percent reimbursement of income tax calculated on the wages of employees performing professional work for the business entity, if the organization or individual entrepreneur maintains a quarterly average of no more than 30 employees. In this case, for small organizations with up to 30 employees, it is also recommended to reimburse expenses incurred by the business entity for business trips related to employee training and development. For this purpose, a sub-legislative legal act is proposed to set an upper reimbursement limit, not exceeding AMD 2 million.

• A 25 percent reimbursement of income tax calculated on the wages of employees performing professional work for the business entity, along with equivalent payments, if the quarterly average number of employees is 31 or more,” the Minister noted. Moreover, he added that total state support for each accounting period will not exceed 50% of the income tax paid for that period.

It was also noted, that upon adoption of the legislative package, by-laws will specify eligible activities and procedural guidelines for state support in high-tech industries.

The Minister informed that the state support will be managed through a self-service software platform expected to launch by July 1, 2025. Until then, applications will be handled by the order of the authorized body. The support period spans from January 1, 2025, to January 1, 2032. Businesses on the turnover tax system will initially receive support after three years and may continue if they switch to the general taxation system.

The support outlined in the draft laws will be available to organizations and individual entrepreneurs operating under the general taxation and turnover tax systems from January 1, 2025, to January 1, 2032. Additionally, an organization or individual entrepreneur operating under the turnover tax system will be eligible for support after the end of the third calendar year following the relevant year. They may continue receiving support if they subsequently operate under the general taxation system.

Following this, a reference was made to the tax benefits provided by the package of the draft laws:

First direction of Tax Benefits:

• Reduction of turnover tax rate by 2.5 times, setting it at 2 percent instead of the previous 5 percent.

• An additional 200% deduction of gross income for professional staff salaries (capped at 50% of the tax base).

• Revising the rules for recognizing gross income for taxation purposes for targeted funds received by business entities that reported an average of up to 30 employees during the tax year. Under this revision, these funds will be recognized as income not in the tax year they were received, but in the tax year when the funds—or any assets acquired, constructed, created, or developed using them—are recorded as an expense or loss

Second direction of Tax Benefits:

• Reducing the income tax rate by half, from 20 percent to 10 percent, on salaries and equivalent incomes paid to professional staff involved in R&D activities.

• Allowing an additional reduction of gross income for profit tax purposes by up to 200 percent of the salaries paid to professional staff, capped at 50 percent of the calculated tax base.

• Establishing a minimum amortization period for fixed assets used in scientific research, development, and experimental work, which can be set by the profit taxpayer at their discretion but must be at least one year.

• For profit tax purposes, allowing gross income to be reduced by the full amount of expenses incurred directly by the taxpayer, or on their behalf, in the scope of scientific research and experimental development, within the tax year in which the expenses are incurred.

It is also proposed that these privileges related to research and development activities apply to business entities that meet standards set by the RA Government and receive a positive assessment from a professional committee formed by the Government.

Tax benefits will be provided for seven years, from January 1, 2025, to January 1, 2032. Additionally, the option to further reduce gross income by 200 percent of wages paid to professional staff for profit tax purposes will also be available for the 2024 reporting year.

"By adopting this legislative package, we expect to create favorable conditions for the progressive development of the high-tech industry and to advance research and development activities. It is also anticipated that this will stimulate productivity and competitiveness in Armenia's economy, foster the growth of a knowledge-based economy, promote the formation of an information society, attract foreign investments, and support the export of local products and services, positioning Armenia as a country with a growing reputation in high-tech development, stated Mkhitar Hayrapetyan.”

Committee Chairman Babken Tunyan noted that the bill had been discussed within the committee in a working format, in addition to hearings held with industry companies. Following this, MPs Tadevos Avetisyan, Hovik Aghazaryan, and NA Deputy Speaker Hakob Arshakyan raised questions for the Minister, who provided relevant clarifications.

Minister Mkhitar Hayrapetyan emphasized that the regulations proposed by the legislative package are based entirely on research data and analysis.

The proposals made by NA Deputy Speaker Hakob Arshakyan and Deputy Khachatur Sukiasyan regarding the bills were also discussed. As a result, it was decided that all proposed changes will be reviewed, with the final stance to be discussed between the first and second readings.