A New Step Towards a Knowledge-Based Economy: The Armenian Government Has Approved the Project Submitted by the Ministry of High-Tech Industry

The Government of the Republic of Armenia approved the draft resolution of the Government of the Republic of Armenia “On Amendments and Addenda to the Resolution of the Government of the Republic of Armenia N195-N, dated February 13, 2025.” The proposed amendments and addenda to the resolution were presented by the Minister of High-Tech Industry of the Republic of Armenia Mkhitar Hayrapetyan at the March 6 session of the RA Government.

The Minister referred to the regulations set forth in the package of laws “On State Support for the High-Tech Sector” and “On Amendments and Addenda to the Tax Code of the Republic of Armenia” adopted on December 4, 2024, detailing the seven-year state support and tax privileges for the high-tech sector. “If previously the RA Government mainly targeted the IT sector, encompassing software development, computer program development, and data processing, then for the first time we have established clear definitions of high-tech in the legislation, considering international experience and standards. This program is based not only on the IT sector but also on the high-tech industry, which is an important prerequisite for forming a knowledge-based economy,” Mkhitar Hayrapetyan emphasized.

Hereby:

· By the decision of the Government of the Republic of Armenia N195-N, dated February 13, 2025, an expert committee was formed to qualify scientific research and experimental development (R&D) as such, the composition of the committee and the procedure for its activities were approved, and the criteria for qualifying R&D and the qualification procedure were established. Furthermore, the amendments and additions approved at today's session suggest the following:

· The Commission, whose members will perform their duties on a non-remunerated basis, consists of six members, including representatives of the RA Ministry of High-Tech Industry, Ministry of Economy, Ministry of Finance, State Revenue Committee, and the National Academy of Sciences. The chairmanship of the Committee is entrusted to the Chairman of the Committee on Higher Education and Science of the RA Ministry of Education, Science, Culture, and Sports.

· The Commission will assess submitted works based on the Frascati Manual 2015 criteria. To qualify as R&D, a project must simultaneously meet all five key criteria outlined in this international guideline.

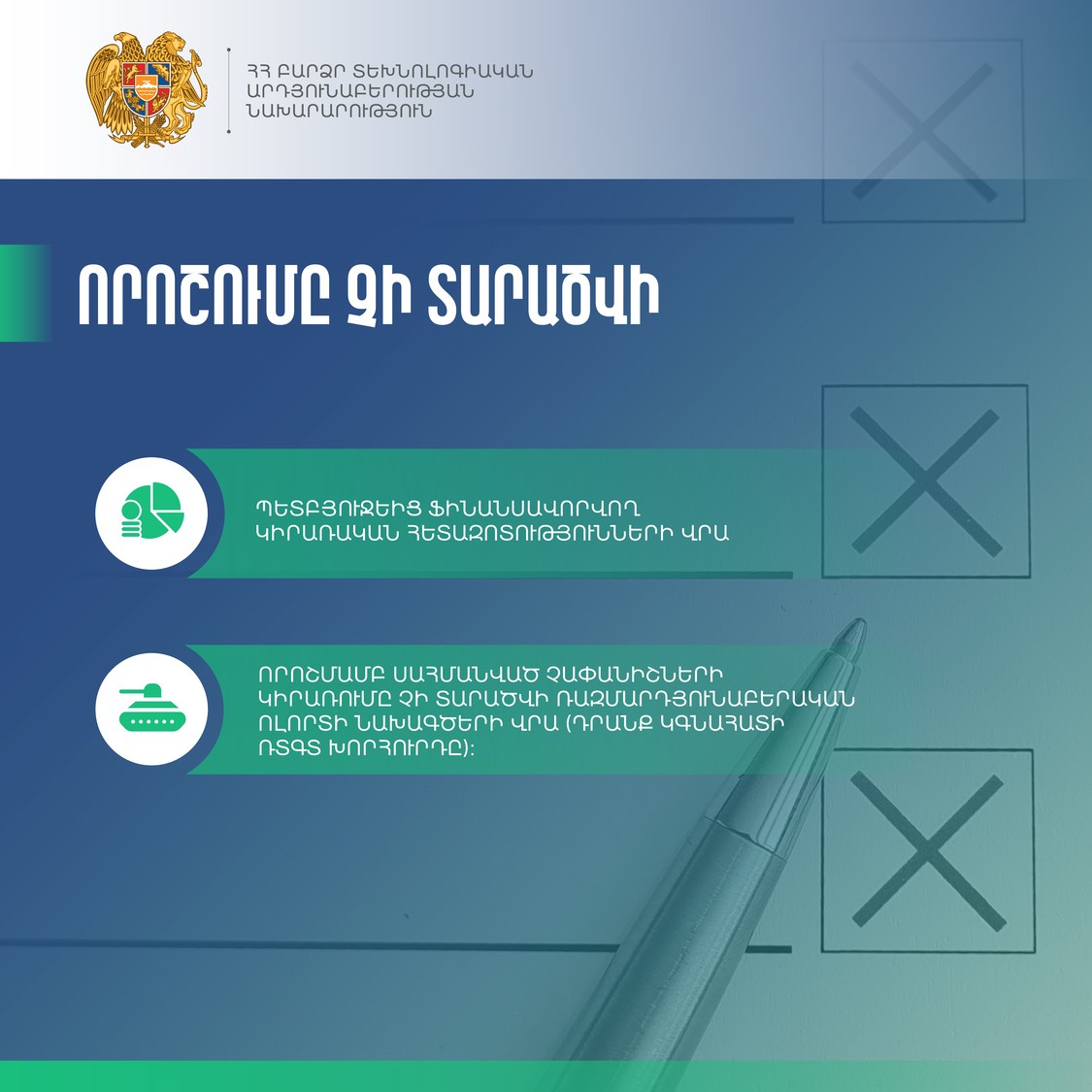

· The decision will not apply to applied research funded by the state budget. While the application of the criteria set by this decision will not apply to projects in the military-industrial sector, they will be evaluated by the Military-Technical and Scientific-Technical Council.

· The Commission’s conclusions will be approved by order of the Minister of Education, Science, Culture, and Sports of the Republic of Armenia.

· Businesses conducting R&D will be able to benefit from the privileges set forth in the Tax Code of the Republic of Armenia, including deductions for calculating profit tax and depreciation deductions. Individuals performing professional work conducting R&D will be able to benefit from the 10% income tax rate.

· Applications will be reviewed in closed sessions of the Commission within a reasonable period of time, but no later than the 365th day after the date of submitting the application.

· The decision stipulates that in the event that applications submitted from April 1 to April 30, 2025, inclusive, are qualified as R&D by the Commission, the privileges shall apply to relations arising from the first day of the month including the date of commencement of the works. Moreover, if the date of commencement of the works is earlier than January 1, 2025, then the aforementioned regulations shall apply to relations arising from January 1, 2025. If the R&D implementation period is scheduled to be later than the date of submitting the application, then the aforementioned regulations shall apply to relations arising from the first day of the month including the date of commencement of the works.